JTKSMs labour standards division director Mohd Asri Abd Wahab said the department had received. Employment law in Malaysia is generally governed by the Employment Act 1955.

Also if youre a manual labourer it doesnt matter what your salary is.

. The main legislation relates to minimum wages in Malaysia are National Wages Consultative Council Act 2011 Act 732 Minimum Wages Order 2020. The law cannot help much in such FINANCIAL situation. The Employment Act 1955 is the main legislation on labour matters in Malaysia.

There is a tripartite body known as the National Wages Consultative Council which is formed. If your employer has been late in paying your salary you can lodge a claim or seek advice. From 1 April 2016 employers must keep detailed employment records including salary records of employees covered by the Employment Act.

So to cut their losses a company may deduct the employees salaries instead. RM 6000 RM 2500 RM 8500. If I still have not received my salary on the 15th of June is the Employer considered late to pay my salary.

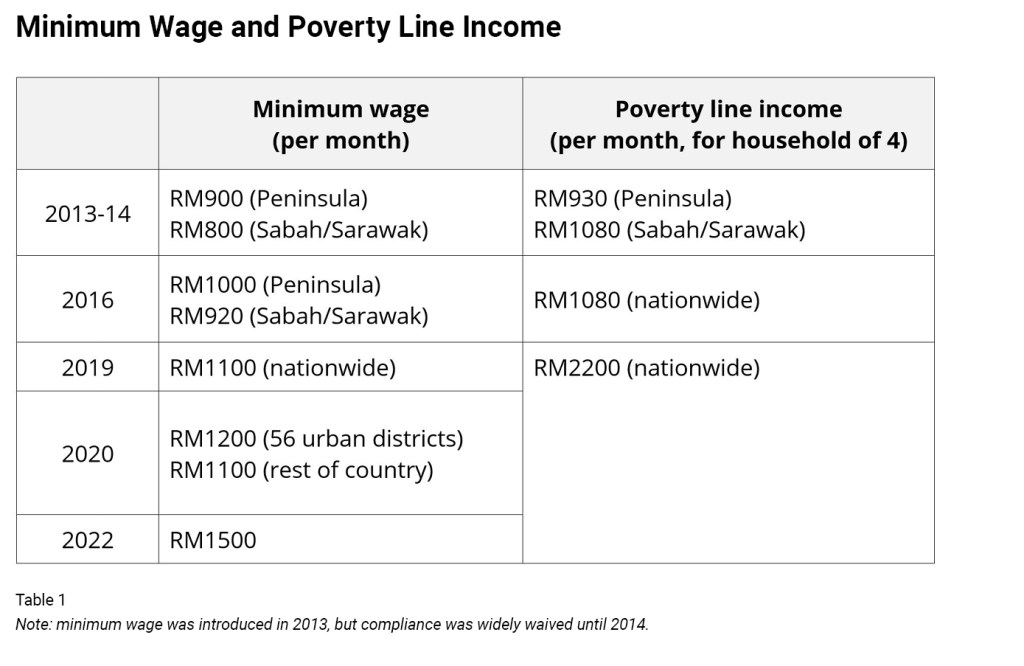

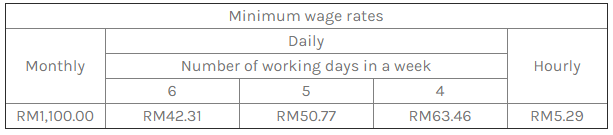

You will be charged for the Late Payment Penalty for every 7 seven days of non-payment. Malaysias minimum wages policy is decided under the National Wages Consultative Council Act 2011 Act 732. Salary must be paid within 7 days of expiry of wage period you are considered lucky and able to receive your wage late for 10 days.

Section 69 of the Employment Act 1955 allows the Director General of Labour to settle disputes regarding wages for employees with monthly pay of up to RM5000. To manually calculate unpaid leave you should ensure that Record Unpaid Leave in Payroll is not ticked under Settings Payment Settings. In North Malaysia Distributors Sdn Bhd v Ang Cheng Poh 2001 3 ILR 387 the court held that the employers unilateral reduction of an employees salary constituted a significant breach of going to the root of the contract of employment.

RM 5500 x 11 refer Third Schedule. Any employee employed in manual work including artisan apprentice transport. Meaning that your salary for May 2021 should be paid by 7 th June 2021.

Who are employed and whose country of domicile is outside Malaysia and who enter and stay in Malaysia temporarily under provisions of any written laws relating to immigration. Your employer must pay your salary on time according to the terms of your employment contract. A payment into an account at a bank or a finance company licensed under the Banking and Financial Institutions Act 1989 in any part of Malaysia being an account in the name of the employee or an account in the name of the employee jointly with one or more other persons.

RM 8500 x 12 refer Third Schedule. Hourly rate of pay means the ordinary rate of pay divided by the normal hours of work. The payment now wont be made until the MD who lives in Germany gets back to the UK later this week so payments will be at least a week late possibly longer.

Employees aged below 60 years old and earns a salary of less than RM5000. Any employee as long as his month wages is less than RM200000 and. Non-payment of salary is an offence.

RM 5500x 12 calculation by percentage. Not surprisingly all employees finances are based on being paid on a specific date each month and the majority of us will incurr charges or forfeit interest on savings and risk rent. Theres a different Act governing people who earn above RM 5000 a month but thatll be covered later in.

For example an employee who works 8 hours a day for a monthly salary of RM130000 would have an. To calculate the daily rate you can divide the monthly salary by either of. We always hope that we do not charge you extra.

Many employees in Many other companies in the Whole of Malaysia and Other Countries also Wait to get their salaries late for weeks and Even Months. This scenario actually takes place more often than we know and one such case happened in 2001. Facts revealed that the claimant on Sept 20 2019 had followed up with Mahindren with regards to his unpaid August salary but his superior.

Fixed Number of Days. Working days in Current Calendar Month including public holidays All Days in Current Calendar Month. Such breach shows that the employer no longer wants to be bound by one of the essential terms of the.

In an interview with human resources lawyer Firdaus Zakaria Astro Awani reported that all employees affected by the MCO must be paid with salary citing that it is in accordance with Employment Act 1955 Prevention and Control of Infectious Diseases Act 1988 and Police Act 1967. Employers in Malaysia are reminded that any salary deductions or cuts cannot be done without the employees knowledge or without approval of the Labour Department of Peninsular Malaysia JTKSM as reported in Bernama. EPF Employer Contribution.

The late payment charge imposed is RM1321 and this must be rounded up to RM14. However if you are late for repayment we will then need to charge you as per the table below. B payment by cheque made payable to or to the order of the employee.

If you are paid late or not paid salary. The Employment Act provides minimum terms and conditions mostly of monetary value to certain category of workers -. In North Malaysia Distributors Sdn Bhd v Ang Cheng Poh 2001 the employers cut the employees pay on the premise that the economy wasnt doing great.

And is calculated by dividing the employees monthly salary by 26. Section 19 of the Employment Act 1955 provides that the Employer shall pay each of his employees within 7 days after the last day of any salary payment period. This is an order for all employees to carry on with work as usual Firdaus explained.

Uae Financial Market Gold Slips On Higher Dollar As Prospect Of Dec Us Goldrateusa Gold Rate Gold Financial Markets

Everything You Need To Know About Running Payroll In Malaysia

Landscape Gardening Jobs Staffordshire Landscape Gardening Lincoln Quite Lands Landscape And Urbanism Architecture Landscape Architecture Garden Architecture

10 Day Payoff Letter Sample Fresh Arizona 5 Day Notice To Pay Or Vacate Form Notice To Payoff Letter Business Letter Template Lettering

What You Need To Know About Payroll In Malaysia

Your Guide To Managing Payroll In Malaysia I Admin

Malaysia S Focus On When To Raise Minimum Wage Must Not Forget Why Fulcrum

Employment Law New Minimum Wage Rates To Take Effect On 1 February 2020 Lexology

Infograpic 20 20how 20to 20create 20multiple 20sources 20of 20income Income Sourcing Investing

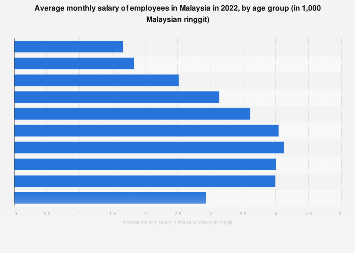

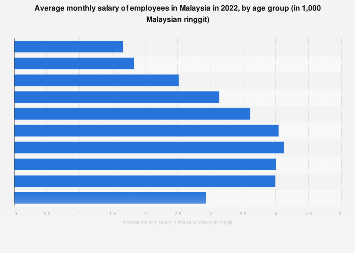

Malaysia Average Salary By Age Statista

What You Need To Know About Payroll In Malaysia

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium

Malaysia S Rm340bn Pemerkasa Package Extended Wage Subsidies And More

No 19 Archicentre Facade Design Facade Architecture Architecture

Speaking About The Problems Of Water Quality In Malaysia Water Quality Water Drinking Water

Get Our Sample Of Dividend Payment Voucher Template For Free Dividend Value Investing Payment

Everything You Need To Know About Running Payroll In Malaysia